Save Facebook advertising costs using arbitrage opportunities

A couple of months ago, I was looking at Facebook Ads to spread the word about this new restaurant my friend is setting up. I’ve always been intrigued about how online advertising works, and the level of potential it has to improve intelligently based on its target users.

So I went through the basic fact-finding – there were 31.26 million Facebook users in India above the age of 18, which isn’t much if you look at the population, but is huge if you look at them as individuals.

Similarly, there were 14.75 million Facebook users (+18 years) in the 4 metros (Delhi, Bombay, Chennai, Kolkata) plus Bangalore, which showed that they were vastly urban, which isn’t surprising coz Facebook has always been more international and private than the desi feel to Orkut that we had a few years ago.

As a primer, allow me to tell you the two basic ways of online advertising. You either Pay for Impressions (CPM) or you Pay per Click (CPC). As is obvious, since a Click means that the customer is really interested, it costs more. So unless you have something to sell that will cover that cost (looking at conversion ratios) and you can preferably close the deal immediately using your website, you wouldn’t want to use CPC for basic word-of-mouth or awareness.

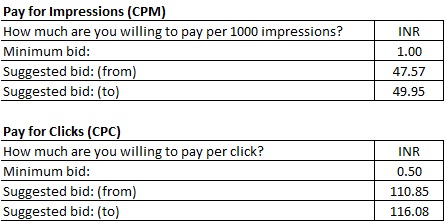

This is how you are charged –

CPM – How much are you willing to pay per 1000 impressions?

CPC – How much are you willing to pay per click?

So I deep dived into Facebook advertising and came up with something quite unexpected.

The costs at the time were –

Note: Facebook strongly recommends bidding within the suggested bid range to increase your advert’s likelihood of receiving impressions.

This would mean that to cover Facebook’s target audience (ages 18+) would cost –

All India: 1 ad per user: INR 1.43 – 1.50 mn

Note: this does not mean that each user will get to see 1 impression each, but that the volume of ads shown will be equal to the target audience size.

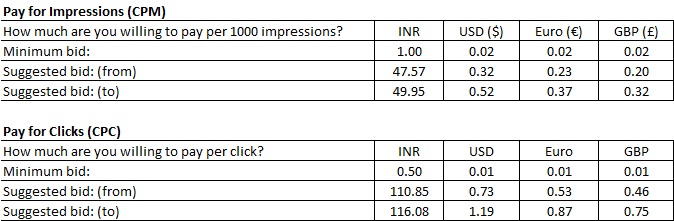

That seemed expensive, so I looked around some more, and came up with this –

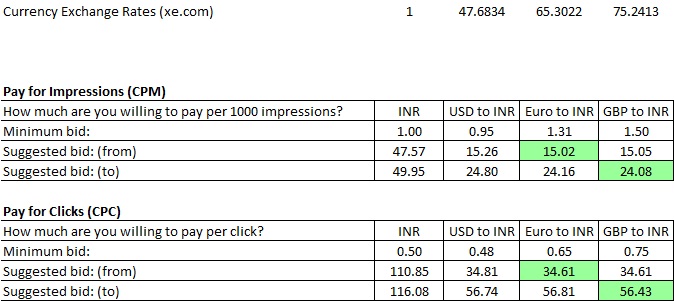

This seemed interesting, so I went ahead and converted these rates and found –

Reference: Prices based on 14th September 2011.

The values marked in green are the lowest for that row.

– that the costs of advertising using all three currencies – USD($), Euro(€) and GBP(£) – were much lesser than using INR.

This means that if you were to pay for Indian advertising using foreign currency, there seems to be an arbitrage opportunity.

Interestingly, even then there are still two strategies that could be adopted –

- If one chooses to stay at the lower end of the suggested range of bids, then one should pay using Euro (€).

This amounts to 68%-69% savings vis-à-vis spend in INR.

- If one chooses to stay at the higher end of the suggested range of bids, then one should pay using GBP (£).

This amounts to 51%-52% savings vis-à-vis spend in INR.

I’m quite intrigued about this arbitrage opportunity across currencies when it comes to Facebook advertising costs – and I’m sure Facebook has got to know about this.

The question that remains then is – if Facebook knows about this, WHY does the arbitrage opportunity still exist?

Nice post. Two possible reasons come to mind for FB letting this anomaly persist.

1. FB may not mind keeping some cash in pounds and euros on an ongoing basis, but it could be averse to having buildups in smaller currencies, such as the rupee. So its posted exchange rates on ad purchases might include its own imbedded forex charges for swapping rupees back into other currencies.

2.FB is a fast-growing company with lots of projects happening all at once, and no one noticed how big these anomalies became. Such oversights can happen.

Those are guesses only; I don’t have direct insights. You’d asked on the Forbes site why the accounting is so much tidier for Facebook Credits, which is a smaller part of the overall business. Credits might have been built later, by a more fastidious team. Or, with Facebook already getting 30% of every Credits purchase, the company might have decided that it didn’t need to set exchange rates with imbedded forex conversion charges built in.

Thanks George for your inputs.

I have a feeling it might be more of point 2 than point 1, because the chances that any set of forex charges could be as high as 51%-69% of the value of the currency are improbable, to say the least.

As for the difference in revenue streams, Facebook receives only 30% of Credits’ value whereas they receive 100% of Advertising revenues – which means that, given the size of revenue and the percentage of revenues received by Facebook, there is no reason why exchange rates shouldn’t be more accurate in Advertising than in Credits.

Hence, I think that your point about Credits having been built later by a more fastidious team is probably true.

Finally, one last point I’d like to add is w.r.t. incorporating the Purchasing Power Parity of different countries when it comes to defining advertising costs. If at all, there should be a difference, it should actually be cheaper in India (looking at PPP as mentioned above and the per capita income) than more expensive.

That further gets reinforced by the fact that the last advertising campaign I ran on Facebook in Nov-11 ended up giving me a CPM (per 1000 impressions) cost of INR 3.73 even though I had bid in the recommended range of INR 50 to 55. This shows that there is a HUGE gap between the rates that have been defined and what the market seems to be bidding.